Chartered Certified Accountants

OUTGROWN YOUR ACCOUNTANT?

The reflection point that

supports entrepreneurs to grow their business

with clarity and confidence.

1. DOES YOUR ACCOUNTANT SHARE YOUR VISION?

We support entrepreneurs achieve their business goals through digitally-enhanced accountancy, tax and advisory services.

Whether you are looking to raise finance, expand in the UK, grow internationally, restructure or exit, if you’re our client, your goals become our goals and we throw everything we have at helping you achieve them.

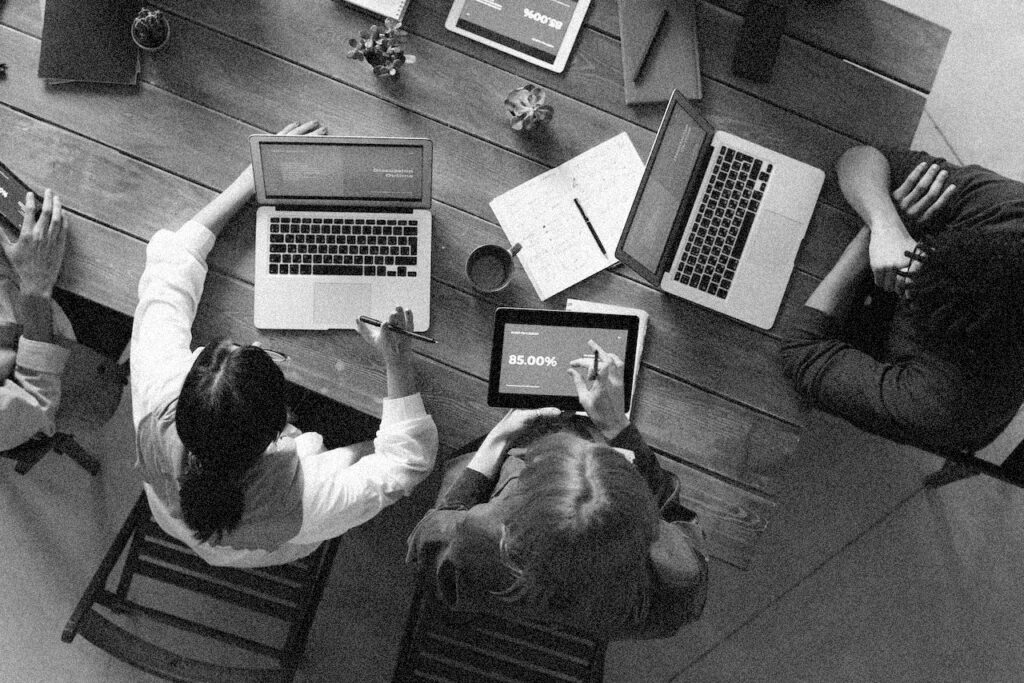

2. DO YOU GET UP-TO-DATE AND RELIABLE FINANCIAL INFORMATION?

Most high street accountants provide a simple bookkeeping function to ensure you statutory obligations are being met.

We combine award winning accountancy services with game-changing technology such as Xero, you provide you with you with real-time financial information so you can capitalise on opportunities, plan better and reach your goals faster.

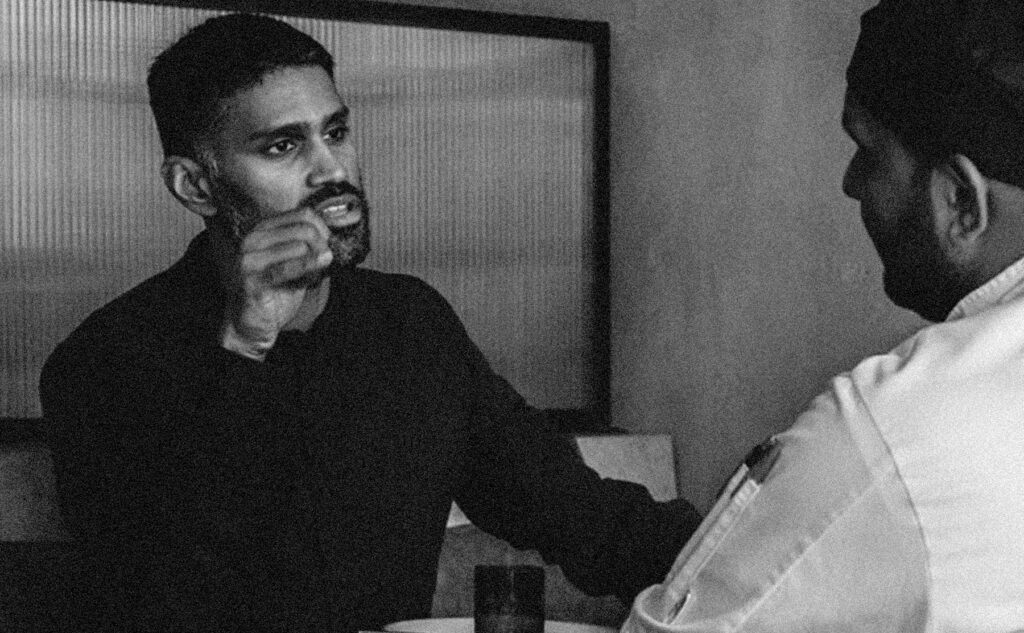

3. HOW OFTEN DO YOU SPEAK TO YOUR ACCOUNTANT?

Communication is key. Especially when it comes to overcoming your business challenges.

We meet regularly with our clients to discuss management accounts, growth plans, operational and commercial issues.

4. AS YOUR BUSINESS GROWS, SECTOR EXPERIENCE BECOMES MORE IMPORTANT.

Many businesses start with a general high street accountant, but after a few years, their lack of specialist industry or technical knowledge may begin to hold your business back.

We have built up significant expertise within key sectors that goes above and beyond routine accounting and tax services .

Trusted by some of the UK's leading SMEs

From start-up’s to global businesses, here just a small but representative selection of our clients:

As well as providing a full-range of accountancy services, we are highly regarded for our sector focus – Hospitality, Retail, Creative and Media, Technology and Property.

Why partner with

Prysm Financial?

Introductory Meeting

To arrange an introductory meeting, or for a quote, please complete the below form.

Trending

Our specialist teams offer expert insight into the most topical issues affecting businesses and individuals right now.